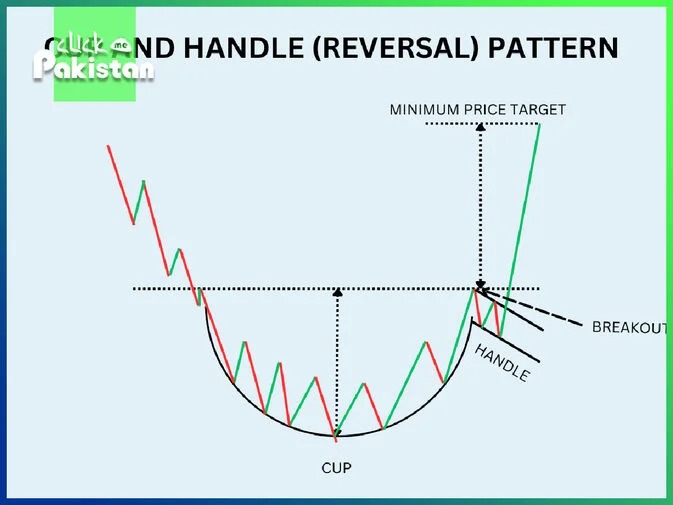

Numerous price formations, such as the cup and handle formation, have been profitable for millions of traders to analyse. The reason behind this is that the tea cup gave rise to the well recognised cup and handle formation in pricing.Making money in the stock markets is possible with this formation, which is among the most well-liked bullish continuation formations. Before we learn the definition of a cup and handle formation and how to read one, let’s take a closer look at the formation using a genuine tea cup. However, there are other factors that play a role in how a formation forms on a chart. Let’s investigate every aspect of the cup and handle formation now, without further ado.

What is a Cup and Handle Formation?

As a continuation formation, a cup and handle formation is bullish. The price trend’s continuation can be determined with its assistance. Known as the “cup and handle formation,” it takes its name from the way the design looks.The future sustainability of the upswing is indicated by a bullish continuation. In the midst of an upswing, a continuation formation would thus emerge to indicate that the uptrend would return when the formation is finished and you have confirmation. Now let us examine the construction and elements of the cup and handle formation.

Cup and handle formation consists of two main parts:

First of all, there has to have been an earlier rise because this is a bullish continuation formation. After that, the handle and cup are produced. It’s believed that the uptrend will continue after the stock price breaks out over the resistance level and you receive confirmation. The foundational elements of the handle and cup design are these.

The Mind Behind Cup and Handle Formation Formation

First off, there was an earlier upward trend in the stock. Traders’ confidence in the stock increases during this upswing. Not many investors who purchased the stock during the rise or at the start of the upswing are profiting well. A small number of unsuspecting investors, however, who do not study the charts, purchase the stock at the red straight line, or resistance level, believing that it would soar even higher. But when the stock gets closer to the resistance level, astute investors who had purchased the stock at the start of the uptrend begin to book profits, which heightens the selling pressure and drives the stock prices down. Fund managers, institutional investors, and astute investors will ultimately intervene to purchase the stock at a discount if its fundamentals are strong. The bottom of the cup, or demand, will be formed as a result, forming a support level.Upon establishing the cup’s bottom, the stock begins to ascend, forming the cup’s right side—the green interior section. This increase in price indicates that large investors are purchasing the stock, which raises demand and drives up the price. Up moves pause in the vicinity of the red line. Nevertheless, why is that the case? This occurs as a result of the traders who witnessed the complete cup formation and chose to hold onto their stock after purchasing it at the left edge in the hopes that it would rise.

How did the handle form, and what role does psychology play in it?

Traders that are afraid sell their stocks at breakeven, a tiny loss, or even a small profit in the handle.

The stock had undergone the whole decline for the traders who had purchased it at the left edge of the cup. The stock did not cover its position at the breakeven point, or the resistance level, even after it moved back towards the right edge. Therefore, they choose to record a little loss when they witness a decline in the share price due to the previous selling pressure, fearing that the prices would drop to the nearest support line, or the base of the cup.

In order to increase the selling pressure, traders who purchased the stock at the bottom of the cup book profits at the resistance level, believing that the price is getting close to its prior highs. There are also few traders that enter the short position believing that there has been a reversal.A shakeout of the weaker hands from the stock is essentially what the handle’s consolidation represents. Let us now discuss the volumes a little bit.

The Cup and Handle Formation’s Volume Analysis High volumes are expected when the stock is getting close to the resistance level due to strong selling. There will also be a little volume when the stock forms a handle. This indicates that affluent individuals who purchased the stock at the bottom of the market are holding onto their investments while weaker players are selling their shares.

Ending Lines

Due to its high success rate and inherent danger, the cup and handle formation is highly sought after by traders. As such, always include a stop loss in your trades. Should things go wrong, this will enable you to reduce your position at a minimal loss? It’s also important to keep a careful eye on the volumes that were recorded during breakout. The rationale for this is that the likelihood of the uptrend continuing is reduced if the stock has little volume during the breakout.

Read Also For More: Compulsory Convertible Debentures: A Comprehensive Guide