In the field of technical analysis, traders and investors utilize a variety of patterns to help them decide which assets to purchase or sell. The Double Bottom Pattern is one such design. This tutorial will give a thorough analysis of the Double Bottom Pattern, including its genesis, importance, interpretation, and practical applications in trading tactics.

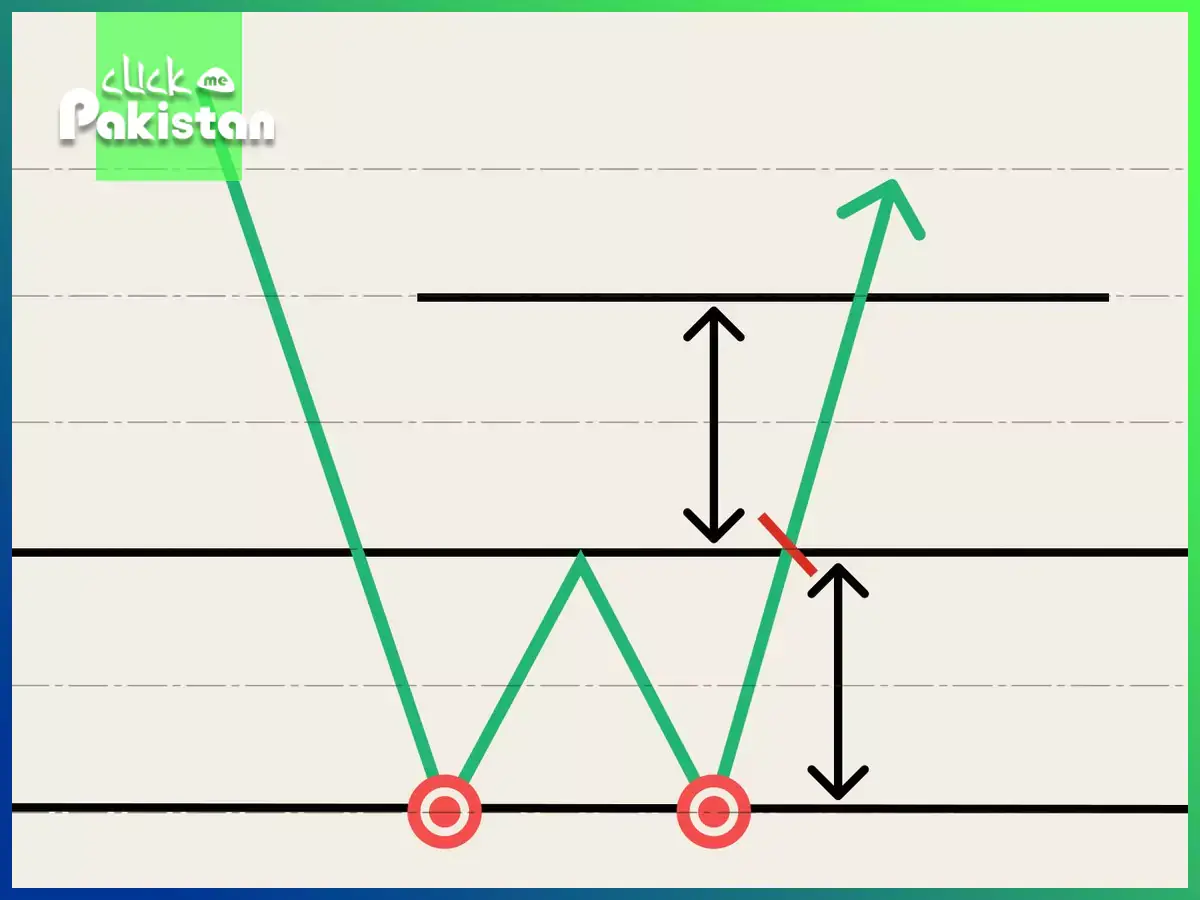

A technical analysis chart pattern known as the “double bottom pattern” may indicate an impending reversal in the asset’s price direction. It usually occurs during a decline and suggests that an upward move in the asset may be imminent. The form of the pattern—two different troughs (bottoms) separated by a peak (top)—resembles the letter “W,” thus its name.

How Does the Pattern of a Double Bottom Form?

Three key phases determine the formation of the Double Bottom Pattern:

First Decline:

The asset’s price drops to a fresh low, forming the pattern’s first bottom. This phase corresponds to the current downward trend.

Come back:

The price rises and forms a peak once it hits the first bottom. This peak serves as a transient level of resistance when the price finds it difficult to rise.

Subsequent Drop and Rise:

After that, the price drops once again, getting closer to the initial bottom’s level. A second bottom forms if the price reaches this level and does not drop below it. The price then bounces back after this, which might indicate the beginning of a fresh upswing.

Important Features of the Double Bottom Design

Look for the following traits in order to recognize and trade the Double Bottom Pattern:

Cost Structure:

There is a peak in between the two separate troughs, or bottoms, that make up the pattern. The prices of the two bottoms don’t have to match exactly, but they should be around the same.

Sound level:

Volume can offer more proof that the pattern exists. Volume is usually higher during the first fall and first bottom formation. When the price rises from the second bottom, it can drop during the peak formation and then rise once again.

Time:

Depending on the asset and the state of the market, the pattern may take many weeks or months to develop. It is often seen as a reversal pattern with a longer time horizon than other patterns such as the Head and Shoulders.

How Can the Double Bottom Pattern Be Traded?

The Double Bottom Pattern trading process consists of many steps:

Determine the Pattern:

On the price chart, look for the distinctive “W” form. Make sure there is a distinct peak between the two bottoms and that they are about similar in size.

Verify the Flow:

Examine the volume and other technical indications to ensure if the pattern is legitimate. Further confirmation may come from a notable spike in volume during the breakthrough.

Make a Trade:

If the price rises over the peak’s created resistance level, you should think about going long (buying). This breakthrough suggests that there may be a fresh upswing beginning for the asset.

Establish Target and Stop-Loss Levels:

Place a stop-loss order just below the second bottom to reduce risk. In the event that the pattern fails, this helps guard against possible losses. Based on the pattern’s height, establish a target price. Usually, the breakout level plus the distance between the bottoms equals the predicted price move

Keep an eye on the volume and price movement once you enter the deal. Depending on the performance of the asset and the state of the market, alter stop-loss levels or take gains as needed.

The Double Bottom Pattern’s Drawbacks

Time-consuming:

The formation of the pattern may take several weeks or months, which may not be convenient for traders seeking for quick profits.

Needs Verification:

For the pattern to be considered dependable, volume and additional indications must validate it. If there is no confirmation, the pattern could generate erroneous signals.

Situation of the Market:

The general state of the market may have an impact on the pattern’s efficacy. In extremely erratic or moving markets, the pattern might not be as trustworthy.

Conclusion

In technical analysis, the Double Bottom Pattern is a useful technique for spotting possible asset price reversals. Traders may utilize the pattern to enhance their trading results and make better judgments by knowing its creation, traits, and trading tactics.

Don’t forget to set suitable stop-loss and target levels, verify the pattern with volume and other indicators, and take the general state of the market into account. The Double Bottom Pattern may be a potent addition to your trading toolset with careful study and experience.

FAQ’s

What is the pattern of the double bottom?

A technical analysis chart pattern known as the “double bottom pattern” has a “W” shape with two troughs and a peak, suggesting a possible reversal from a downward to an upward trend.

How can a Double Bottom Pattern be recognized?

On the price chart, look for two distinct bottoms separated by a high. For confirmation, the price must break above the peak and the bottoms should be about equal.

What is the meaning of a double bottom pattern?

It suggests that the asset may initiate a new positive trend by signaling a possible reversal in the price direction from an uptrend to a decline.

What is the Double Bottom Pattern trading strategy?

When the price breaks above the peak’s created resistance level, enter a trade. Decide on a target price depending on the height of the pattern and a stop-loss below the second bottom.

What are the Double Bottom Pattern’s typical traps?

False breakouts, uneven bottoms, a lack of volume confirmation, and an over-reliance on the pattern are common mistakes. To increase dependability, validate the pattern using volume and additional indications.