Trading professionals frequently utilize the falling wedge pattern as a technical analysis technique to spot possible market fluctuations and make well-informed investment decisions. Comprehending chart patterns such as the falling wedge is essential for forecasting future market movements and refining trading tactics in the trading domain.

The details of the falling wedge pattern, including how it forms, why it matters, and how traders may use it to their advantage, will all be covered in this article.

How Do Falling Wedge Patterns Occur?

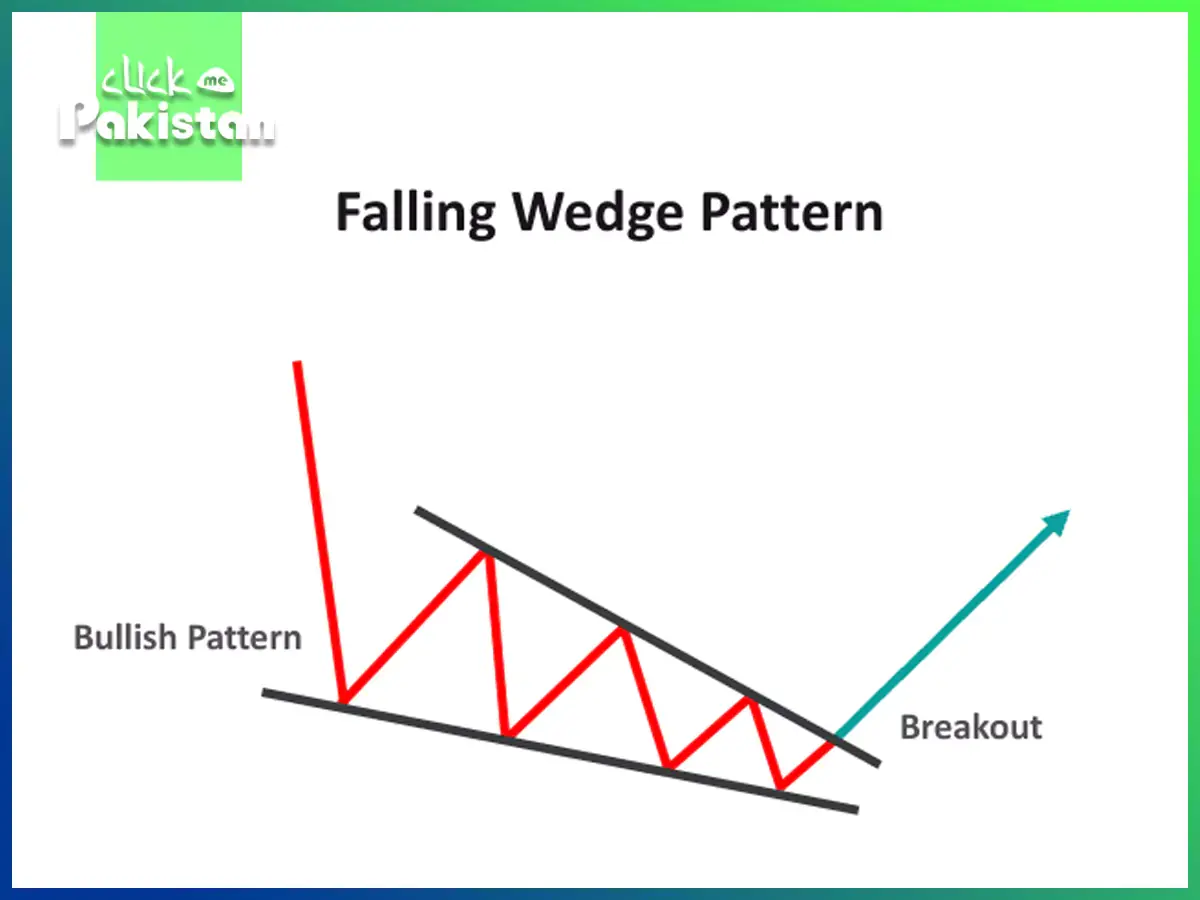

A continuation pattern known as the falling wedge pattern arises when the price oscillates between two downward-sloping, convergent trendlines. Falling wedge patterns are considered bullish chart formations, but depending on where they occur in the trend, they can also indicate continuation or reversal patterns. Because it may be seen as both a bullish continuation pattern and a bullish reversal pattern, it is quite difficult to detect the falling wedge pattern.

The direction of the trend at the point when the falling wedge appears separates the bullish continuation pattern from the bullish reversal pattern. In an uptrend, the pattern is seen as a continuation, and in a downturn, as a reversal.

During a downturn, the falling wedge pattern is a bullish chart pattern that suggests a possible market turnaround. Its characteristic narrowing of the range between highs and lows results in a downward-sloping wedge-shaped pattern. In contrast to other patterns, the falling wedge is usually interpreted as a possible bullish reversal signal, meaning that the price may shortly go upward and that the downward momentum is slowing down.

How the Falling Wedge Pattern Forms?

Traders should search for a few essential components in order to spot a falling wedge pattern:

Declining Price Action:

The pattern starts with a downtrend, or a steady decline in price. The first leg of the wedge is formed by this descent.

Converging Trendlines:

As the pattern develops, the price action’s highs and lows begin to converge, creating two trendlines. Whereas the lower trendline links the lows, the higher trendline connects the highs. While both trendlines have a downward slope, the lower trendline has a sharper slope than the higher trendline.

Volume:

Usually, as the wedge develops, volume falls. As the pattern progresses, the volume reduction is indicative of the waning selling pressure. Upon the breakout, a notable spike in volume is frequently regarded as pattern confirmation.

Breakout:

The price breaking above the higher trendline verifies the falling wedge formation. The downtrend is coming to an end and a possible uptrend is starting, according to this breakout.

How to Trade the Pattern of Falling Wedge?

To optimize possible gains, trading the falling wedge pattern requires many steps:

Determine the Pattern:

Locating the falling wedge pattern on the chart with accuracy is the first step. Seek out the decreasing price range and the convergent trendlines. Make sure that the decline is where the pattern is forming.

Await the breakthrough:

Although there is a bullish indication from the falling wedge formation, it is important to hold off on acting until there has been a verified breakthrough. Above the wedge’s top trendline, the breakout should take place. The breakthrough may be confirmed with a notable rise in volume.

Establish Entry and Exit Points:

After the breakthrough is verified, traders may establish their points of entry. Buying orders are often placed just above the breakout level to make sure the price has really broken out. In order to control risk and guard against conceivable false breakouts, traders should also use stop-loss orders.

Watch the deal:

Following the deal, keep an eye on the volume and price change. Ideally, the price will keep rising, validating the bullish turnaround. To lock in profits and control risk, modify stop-loss orders as necessary.

Illustrations of Falling Wedge Sequences

Let’s examine a few instances to help you comprehend the falling wedge pattern:

First Example:

Reversal of Stock Price: Suppose a falling wedge pattern occurs on a stock that is in a downturn. The gap between the highs and lows gets smaller as the pattern progresses, yet the price still makes lower highs and lower lows. A possible bullish reversal is indicated when the price eventually breaks above the top trendline with greater volume. The ensuing upward trend may have been profitable for traders who saw the pattern early and waited for the breakout.

Example 2:

Cryptocurrency sector: The collapsing wedge pattern is also evident in this sector. The breakout over the top trendline, for example, may indicate a possible bullish trend if a cryptocurrency is in a protracted decline and forms a falling wedge formation. Using this knowledge, traders might open a long position and profit from the anticipated price increase.

Common Errors to Steer Clear of

Traders should be mindful of the following typical errors while using the falling wedge pattern:

Premature Entries:

If a transaction is made before the breakout and the pattern doesn’t show up, losses may result. It is imperative that any trading choices be postponed until after a verified breakout.

Ignoring Volume:

The confirmation of the falling wedge pattern depends heavily on volume. A breakthrough that doesn’t have much volume might be an indication of a poor signal. As you analyze the pattern, keep loudness in mind at all times.

Ignoring Market Conditions:

The general state of the market should be taken into account while evaluating the falling wedge pattern. A pattern that emerges during a period of extreme volatility or a significant downturn may have distinct ramifications.

Conclusion

Technical analysts can gain significant insights into probable bullish reversals during downtrends by using the falling wedge pattern. Through comprehension of its creation, relevance, and trading tactics, traders may enhance their trading approaches and make better judgments.

Always keep market circumstances and risk management techniques in mind, and confirm the pattern with a breakout and more volume. Gaining proficiency in the falling wedge pattern can improve your trading abilities and lead to profitable trading results with time and experience.

Technical analysis reveals that a descending wedge formation is bullish, meaning that the downward trend is losing strength. It implies that either the present trend will continue or turn around.

The conclusion of the consolidation or corrective phase is indicated by the falling wedge pattern. Price consolidation is seized upon by buyers as an opportunity to outmaneuver the bears and push prices upward.