Traders and investors are always looking for tools and strategies to help them navigate the complex world of financial markets and predict patterns in price movements. The market in and out falling wedge pattern is one of the more prominent technical analysis concepts among these tools. This pattern offers insightful information on probable price developments and market reversals.

We will go into the details of the market and its falling wedge in this extensive tutorial, looking at its creation, ramifications, and trading tactics based on this pattern.

What Is the Falling Wedge in the Market In and Out?

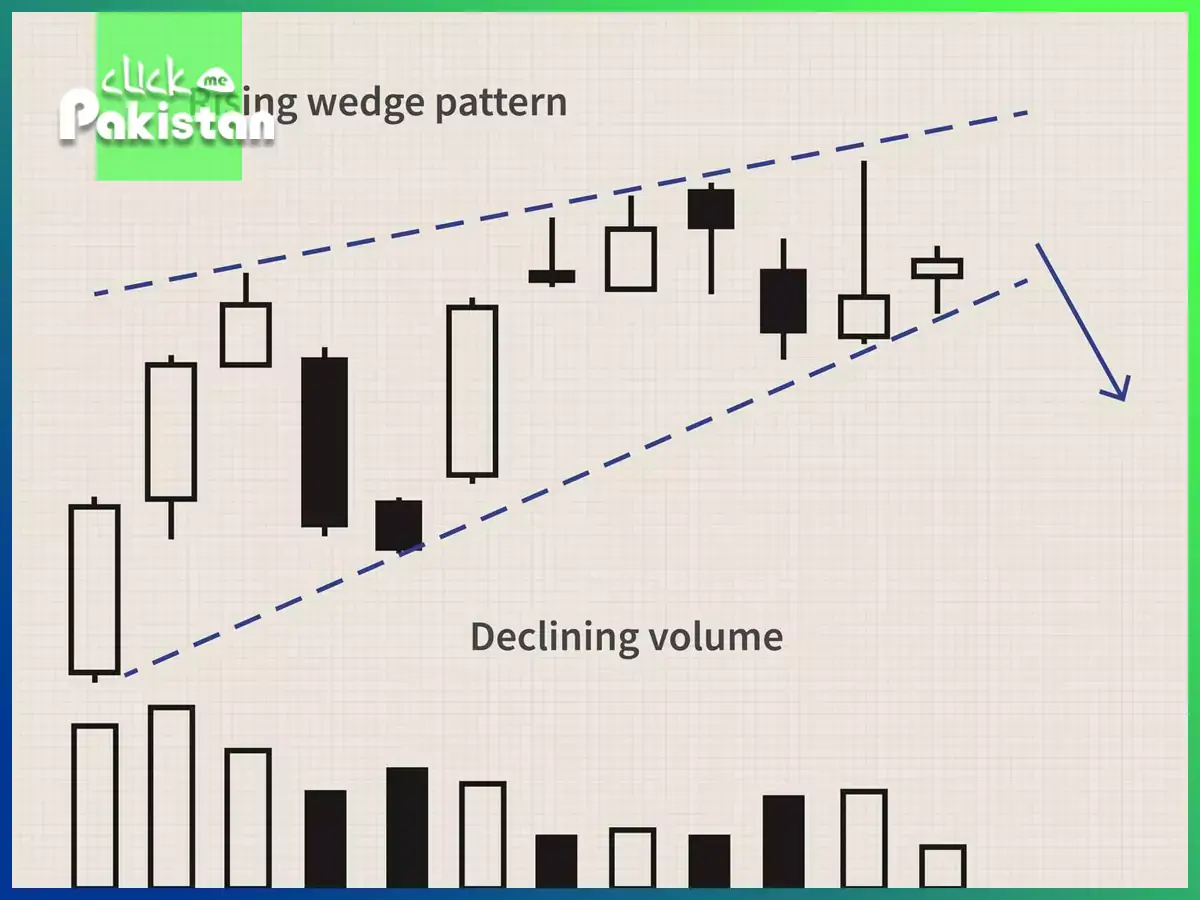

A technical analysis pattern called the market in and out falling wedge may be seen on price charts and is useful for spotting possible reversals in declining trends. The trendlines in the pattern converge to produce a downward-sloping wedge-like shape. The falling wedge pattern points to a possible bullish reversal, in contrast to other patterns that can point to a continuation of the trend.

Because it frequently indicates that the downtrend is losing steam and that an upward trend may be imminent, this pattern is seen as positive. “Market in and out” describes how price movement moves inside the wedge’s convergent trendlines before ultimately bursting out.

The In and Out Falling Wedge Formation in the Market

Traders must comprehend the creation of the market and its essential elements in order to utilize it in and out of falling wedges.

First Decline:

The pattern begins with a steep first decline in which the price is continuously falling. The first leg of the falling wedge is formed by this downtrend.

Converging Trendlines:

The price movement creates two converging trendlines as the decline deepens. Lower lows are connected by the lower trendline, while lower highs are connected by the upper trendline. The top trendline has a less severe slope than the bottom trendline, but both trendlines still slope downward.

Breakout:

When the price breaks above the top trendline, the falling wedge pattern is verified. This breakthrough suggests that the market may be turning around and that an upward trend is about to commence.

How to Trade the Falling Wedge In and Out of the Market?

There are many phases involved in trading the market in and out of falling wedges in order to maximize possible rewards and efficiently manage risk:

Identify the Pattern :

The falling wedge pattern on the price chart must be correctly identified as the first step. Make sure the pattern is developing within a downtrend by keeping an eye out for the converging trendlines.

Await the Breakout:

While the collapsing wedge offers a bullish indication, it is essential to hold off on acting until there has been a verified breakout. Together with more volume, the breakout should take place above the wedge’s top trendline.

Choose Entry and Exit locations:

Traders can choose their entry locations when the breakthrough is verified. Placing purchase orders just above the breakout level is a standard tactic to make sure the price has really broken out. Set stop-loss orders as well in order to control risk and guard against false breakouts.

Transaction Monitoring :

After you enter the transaction, keep a close eye on the volume and price movement. In a perfect world, the price would increase further, validating the positive reversal. Stop-loss orders can be adjusted as necessary to control risk and lock in gains.

Take Profits:

Use technical indicators, past resistance levels, and other market variables to help you determine your profit objectives. Clearly defining profit objectives facilitates efficient trade management and maximizes possible earnings.

Market In and Out Falling Wedge Examples

Let’s look at a few instances to demonstrate how the market in and out falling wedge is used in practice:

Stock Market Example:

Let’s say that after a protracted slump, a stock begins to form a falling wedge pattern. The price action narrows between the converging trendlines as the pattern progresses. Traders may start a long position if they recognize the pattern and wait for the breakout over the upper trendline with higher volume. This early detection might result in large gains if the price keeps rising.

Cryptocurrency Example:

The falling wedge pattern is also discernible in the erratic realm of cryptocurrencies. In the event that a cryptocurrency undergoes a downward trend and develops a falling wedge, a bullish reversal might be indicated by a breakthrough above the upper trendline accompanied by a spike in volume. With this knowledge, traders may initiate a long position and profit from the expected upward trajectory.

Final Thoughts

For traders looking to spot possible bullish reversals in a downtrend, the market in and out falling wedge pattern is a useful resource. Traders may improve their trading techniques and make better judgments by knowing its formation, relevance, and trading tactics. Recall to always take market circumstances and risk management techniques into account, as well as to validate the pattern with a breakout and higher volume. Gaining a thorough understanding of the market and its falling wedge may help traders achieve better trading results and enhance their investing methods.